Irs Tax Forms Schedule C . It’s filed alongside form 1040, one. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. You fill out schedule c at tax time and attach it to or file it. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. irs schedule c is a tax form for reporting profit or loss from a business. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

from worksheetdbmarco.z19.web.core.windows.net

schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. irs schedule c is a tax form for reporting profit or loss from a business. It’s filed alongside form 1040, one. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. You fill out schedule c at tax time and attach it to or file it. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and.

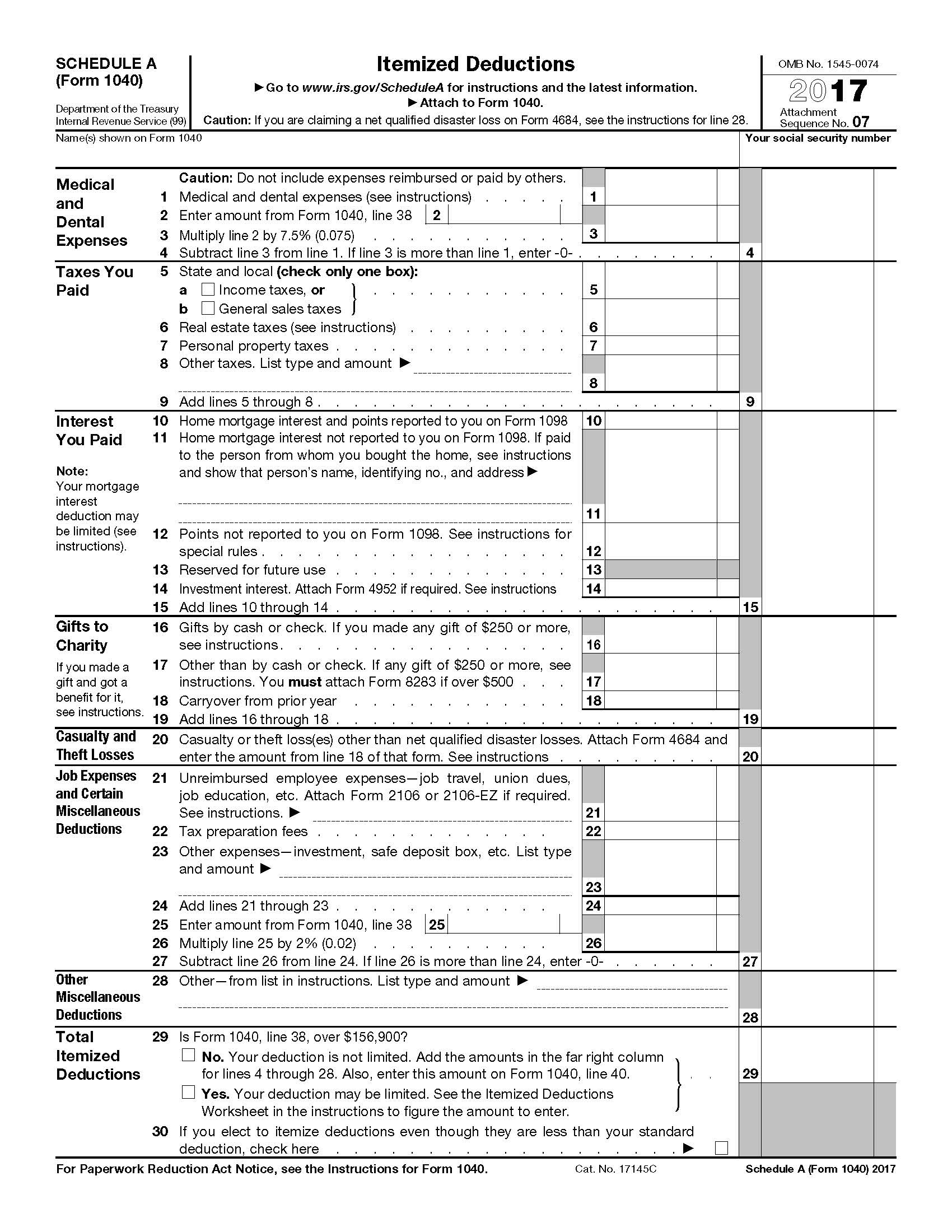

Schedule A 1040 Worksheet Template

Irs Tax Forms Schedule C You fill out schedule c at tax time and attach it to or file it. irs schedule c is a tax form for reporting profit or loss from a business. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. It’s filed alongside form 1040, one. You fill out schedule c at tax time and attach it to or file it. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated.

From lessonlibkindnesses.z21.web.core.windows.net

Schedule C 2019 Pdf Irs Tax Forms Schedule C It’s filed alongside form 1040, one. You fill out schedule c at tax time and attach it to or file it. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. download and print the official form for reporting profit or loss from business (sole proprietorship) for. Irs Tax Forms Schedule C.

From materialschoolwexler.z4.web.core.windows.net

Schedule C Tax Form Printable 2020 Irs Tax Forms Schedule C schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business. Irs Tax Forms Schedule C.

From oliyjacquie.pages.dev

2024 Schedule C Form Marga Eugenia Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. irs schedule c is a tax form for reporting profit or loss from a business. It’s filed alongside form 1040, one. schedule c is a tax form used by unincorporated sole proprietors to report their. Irs Tax Forms Schedule C.

From www.metaxaide.com

Describes new Form 1040, Schedules & Tax Tables Irs Tax Forms Schedule C download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. irs schedule c is a tax form for reporting profit or loss from a business. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web. Irs Tax Forms Schedule C.

From rosebmerrie.pages.dev

Irs Estimated Tax Forms 2024 Printable Judy Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. It’s filed alongside form 1040, one. irs schedule c is a tax form for reporting profit. Irs Tax Forms Schedule C.

From tresaqkorney.pages.dev

2024 Form 1040 Schedule 5 Instructions Pdf Cele Meggie Irs Tax Forms Schedule C download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. You fill out schedule c at tax time and attach it to or file it. schedule c. Irs Tax Forms Schedule C.

From www.taxgirl.com

What’s New On Form 1040 For 2020 Taxgirl Irs Tax Forms Schedule C schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year. Irs Tax Forms Schedule C.

From catheqcarmencita.pages.dev

2024 Schedule 1 Irs Instructions Marne Sharona Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. You fill out schedule c at tax time and attach it to or file it. It’s filed alongside form 1040, one. information about schedule c (form 1040), profit or loss from business, used to report income. Irs Tax Forms Schedule C.

From www.pdffiller.com

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. irs schedule c is a tax form for reporting profit or loss from a business. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. Web. Irs Tax Forms Schedule C.

From lessoncampussastruga.z21.web.core.windows.net

Irs Form 1040 Reconciliation Worksheet 2022 Irs Tax Forms Schedule C It’s filed alongside form 1040, one. irs schedule c is a tax form for reporting profit or loss from a business. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. information about schedule c (form 1040), profit or loss from business, used to report income or loss. Irs Tax Forms Schedule C.

From www.efj.org.jm

IRS Form 4852 walkthrough (Requesting Substitute Form W2 or Form 1099 Irs Tax Forms Schedule C irs schedule c is a tax form for reporting profit or loss from a business. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. You fill out schedule c at tax time and attach it to or file it. information about schedule c (form 1040), profit or. Irs Tax Forms Schedule C.

From lessonlibkindnesses.z21.web.core.windows.net

Schedule A Form 1040 Pdf Irs Tax Forms Schedule C You fill out schedule c at tax time and attach it to or file it. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. It’s filed alongside form 1040, one. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023.. Irs Tax Forms Schedule C.

From www.uslegalforms.com

IRS 1040 Schedule C 2019 Fill and Sign Printable Template Online Irs Tax Forms Schedule C download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. irs schedule c is a tax form for reporting profit or loss from a business. It’s filed alongside form 1040, one. You fill out schedule c at tax time and attach it to or file it. information about. Irs Tax Forms Schedule C.

From lessonlibunderscore.z21.web.core.windows.net

Calculate Schedule C Tax Irs Tax Forms Schedule C irs schedule c is a tax form for reporting profit or loss from a business. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. Web. Irs Tax Forms Schedule C.

From astps.cpaacademy.org

IRS FORM 1040 SCHEDULES C AND E SIMILARITIES AND Irs Tax Forms Schedule C You fill out schedule c at tax time and attach it to or file it. information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. irs schedule c. Irs Tax Forms Schedule C.

From lessonlibkindnesses.z21.web.core.windows.net

Schedule C Tax Calculator Irs Tax Forms Schedule C You fill out schedule c at tax time and attach it to or file it. download and print the official form for reporting profit or loss from business (sole proprietorship) for tax year 2023. irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. information. Irs Tax Forms Schedule C.

From www.dontmesswithtaxes.com

New for 2019 taxes revised 1040 & only 3 schedules Don't Mess With Taxes Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. It’s filed alongside form 1040, one. download and print the official form for reporting profit or loss. Irs Tax Forms Schedule C.

From davidphen1963.blogspot.com

Irs 1040 Form / Tax Tuesday Are You Ready To File The New Irs 1040 Form Irs Tax Forms Schedule C irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. You fill out schedule c at tax time and attach it to or file it. It’s filed alongside. Irs Tax Forms Schedule C.